Yesterday the Financial Times ran an opinion article titled Value Investing is a Very Long Game (link), which I took issue with. I agree that “value investors have to think in terms of decades, not years,” but then why does the author focus so much on what’s cheap versus expensive today? But also, think about it – if a value stock outperforms for decades, doesn’t it at some point get expensive? The article cites research by Professor Edward Finley of the University of Virginia, Cliff Asness of quant fund AQR, and Rob Arnott of Research Affiliates, on why value outperforms growth over the long-term. I don’t put much weight on this sort of statistical analysis. For me, every investor is a value investor, and if its not about the long-term prospect of an individual company, then it’s not really investing – at least not the way I define stock investing. People who get caught up in classifying stocks into value and growth buckets are by definition succumbing to short-term thinking. The article did offer some interesting insights on why classifications like “momentum,” “low-volatility,” “cheap,” or “high quality,” are all situational, and as such subject to changing over time as perceptions change. While the author seems to appreciate this important nuance, he doesn’t seem to be able to shake off the value/growth label when he concludes that “valuations help determine long-term returns.” Its hard to argue with such a statement, until you try to define “valuation.” Is a stock trading at a high multiple on next year’s earnings expensive? Not if it will be 10-times bigger and considerably more formidable ten or twenty years from now. In the end it comes down to predicting the future, which is something no one can do. Yes, its true that investing is a very long game – and precisely for that reason, I prefer to rely only on the highest quality companies with long track records of value creation. Strong cultures, defendable high-quality businesses, and durable growth opportunities matter a whole lot more than a multiple on near-term profit. Value is not something to be captured today. It is created over time. Now that is not to say that one should be agnostic to valuation (we are not), but merely that when valuation is being assessed, that it is done with a long-term lens. Investing is far from simple, and it is not a good idea to ignore anything, but for us, the fact that a stock screens as “cheap,” is rarely ever a reason for us to become more interested.

But how about the macro outlook? Doesn’t the state of the economy matter to the market? Inflation, interest rates, earnings estimates – aren’t those important factors to consider when investing in a stock portfolio? My answer is that they all matter, but hardly as much as most people seem to think. The chart below shows that its never a straight line. While buying after a crash or a pullback is obviously preferable to doing so after a big run, the US stock market has been a reliable compounder of wealth over the ages. But even the clear evidence presented in this long-term chart understates how much wealth the outstanding companies deliver to their owners. Why own “the market” when you can own a portfolio of only those few companies that are outstanding? That is precisely what compelled me to start Victori. It’s not just about finding those special companies, but having the mindset, the culture, and the client base that is educated and equipped to own them through the ups and downs that come with the territory. Trying to buy them when they are low, and selling them when they are high, does not work nearly as well as just letting them work for you – but many self-proclaimed “value” investors will tell you otherwise.

The Nasdaq did considerably better than the S&P 500 after the Covid stimulus created a bit of a bubble in concept stocks, but this appears to have largely been reversed by the Fed’s aggressive rate hiking campaign. “Value” investors might still take issue with the average valuation of the type of growth stocks that drive the Nasdaq, but I am confident that the ones that keep growing faster, and getting better, will appreciate more rapidly over the long-term – even if they still need to go lower first.

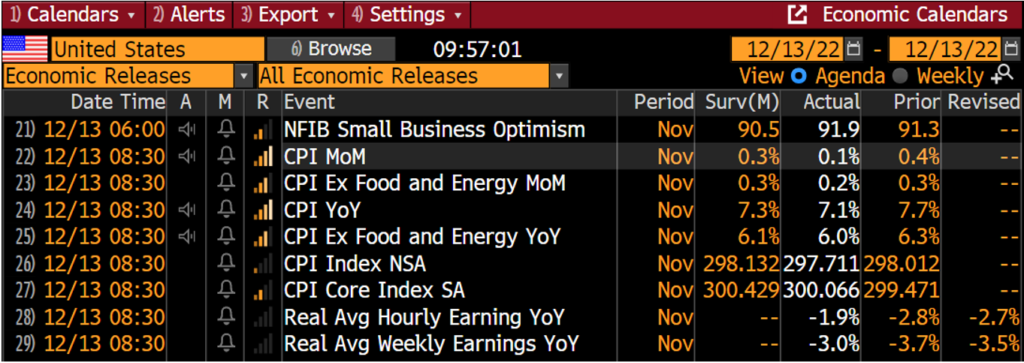

While on the topic of unknowables, here are the economic figures that were released at 8:30 this morning. Consumer prices in November rose at a slower rate than was expected, which caused the futures market to pop about 4% higher on the news.

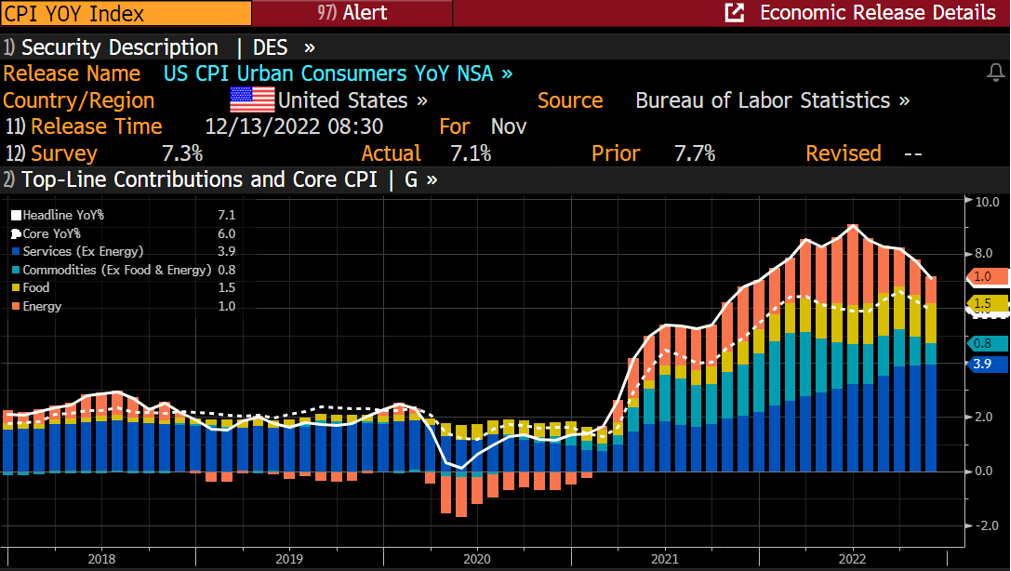

The Services and Food components of inflation are proving stubborn, but the other components are shrinking – particularly commodities.

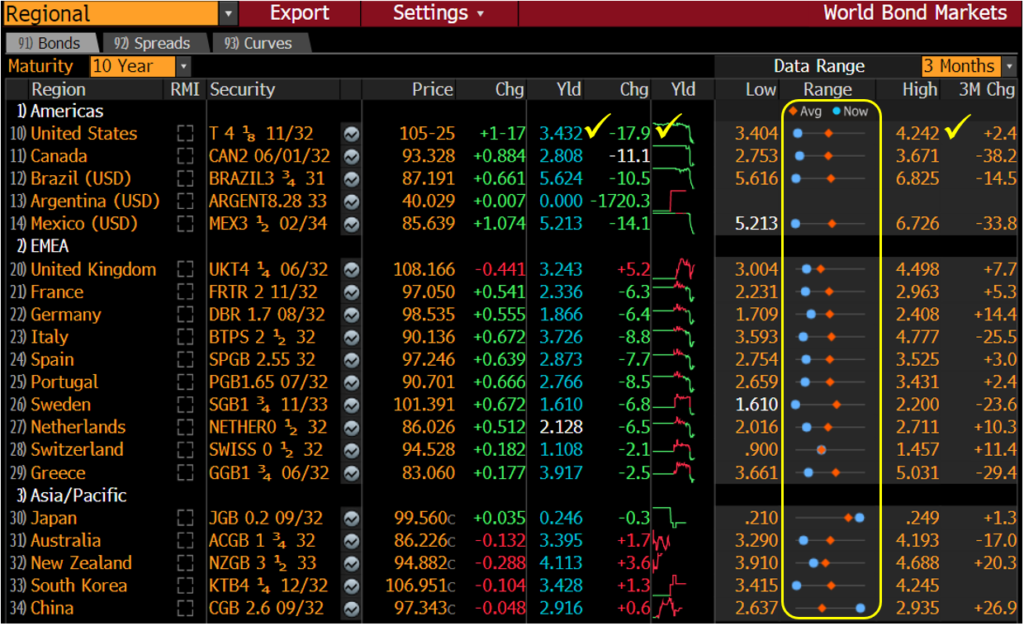

Interest rates have come way down and are at or near their 3-month lows globally – except in Switzerland and China.

The dollar took a hit on the CPI news, but it has been falling for the last two months. Exchange rates were a big headwind for US multinational companies in the third quarter, and it was a big factor in the guidance that these companies issued during earnings season.

This chart shows how the 2023 aggregate EPS estimate of the S&P 500 got cut sharply during the Q3-2022 earnings season – largely on the back of exchange rates, but also due to a consensus view that the US will be in recession next year.

We may not know what comes next, but that doesn’t mean we cannot recognize where we have been. By my definition, a bull market is when the slope of the 150-day moving average of the S&P is positive – a condition that ended in the first quarter of this year. Bear markets are not fun, but they are healthy and necessary for wiping out the froth. Usually you know that a bear market has played its course when a bull market genius ends up in jail – which one just did last night. I am not making a market call, but even if I were, it would not mean much given how we invest. That said, if I squint – I think I see that 150-day line turning up.