By Tim Lee, Jamie Lee, and Kevin Coldiron, December/2019(240p.)

Published two months before the great jump in money supply of 2020, this book questions the notion that stocks keep going up purely because the Fed is pumping money into the economy. If indeed “markets were really inflated by the Fed’s extreme money creation,” it reasons, “then prices of commodities, goods and services, and wages would have risen eventually also.” It concludes that “the true reason that the US stock market rose is that the S&P 500 has become a carry trade and the Fed’s QE policy represented a massive selling of volatility.” While the angle is thought provoking, I was disappointed that the authors made little attempt to explore the bull case. Instead of focusing on the strengthening Fed put, they focused on the bearish theme that probably inspired the writing of the book five years ago: That carry trades are like Ponzi schemes. On the back cover, Edward Chancellor, who authored Devil Take the Hindmost: A History of Financial Speculation, warns: “Carry trades involve picking up nickels in front of a steamroller. Investors who wish to avoid getting flattened should read this book” – while GMO’s Jeremy Grantham calls it: “An important and unusual book. Critical not just for investors but for all of society.” If asked for a catchy one-liner today, mine would have to be: “Don’t fight a Fed on steroids.”

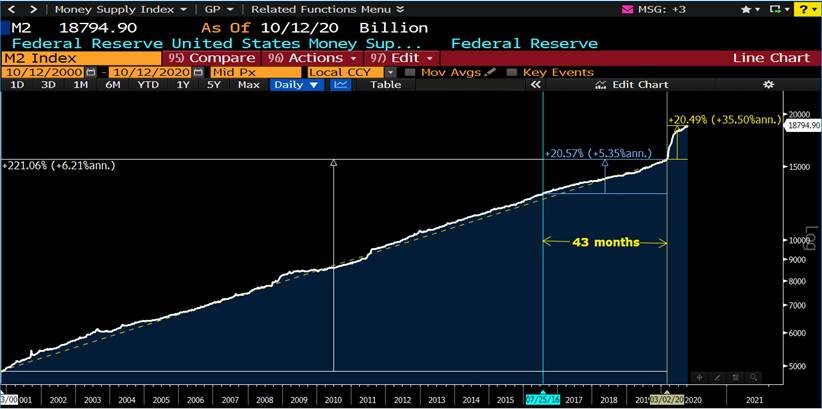

Source: Bloomberg

Source: Bloomberg

The primary author is Tim Lee, who these days runs an economics consulting firm called pi Economics, but who spent over two decades as an economist on the buyside, where he claims (in his bio) to have predicted the global financial crisis of 2007-9. He’s written two other books (one in 1992 and another in 2003) – but this is the first time he publishes with co-authors, one of which (Jamie Lee), appears to be his son. The other author is Kevin Coldiron, a professor in Asset Management at the UC Berkeley’s Haas Business School, who worked for 25 years in quantitative finance.

Their view of markets through optionality and liquidity is not novel, and neither is the warning that leverage is systemically dangerous and deflationary, and that US Fed intervention creates moral hazard and incentivizes leverage and speculation. What is unique in this book is the granular explanation of the actual mechanism through which liquidity gets created and transferred, from the weak to the strong, and particularly in times of crisis. Such mechanism arguably exists in all levels of society and the economy (under different guises), including the sovereign level, where each subsequent crisis transfers more wealth and power to the US Fed (the world’s liquidity provider of last resort). “Long term,” the authors warn, “this leads to three critical outcomes. First, it makes prospering in financial markets less about competence and more about insider status, as insiders with weak balance sheets are able to survive carry crashes thanks to central bank action. Second, it reinforces wealth inequality by truncating losses for already wealthy investors who do not necessarily need, but nevertheless benefit from, action to suppress volatility. Last, the distinction between economic recessions and financial market downturns becomes increasingly blurry. Recessions no longer cause severe asset price declines, or bear markets; they are a function of the asset price declines.” While its hard to disagree that markets can behave “terribly” in the short term, I disagree that this is a new thing or even that it is inherently unstable. If anything, markets used to benefit insiders more in the past than they do in the information age, and with volatility and rates suppressed by liquidity and intervention, it does not have to be a problem, but merely a reality (sign of the times), that leverage runs high and sharp corrections will ensue (i.e. no free lunch).

My biggest rub with the book, which is a rub I would have with any book focused on a single macro topic (so not the author’s fault), is that it makes no attempt to explain, or even acknowledge, that there is more to some stocks (i.e. those of outstanding companies) who’s appreciation over longer stretches of time, have less to do with Fed policy and carry trades than meets the eye. One compounds beyond imagination, while the other mean-reverts in time. Likewise, there are many companies and investors who take a long-term view and do not use leverage, who will still continue to benefit from the trends this book describes. In other words, markets don’t have to be dangerous, unless you are trying to use it for rent-seeking arbitrage instead of a mechanism for rewarding true value creation. At the end of the day, any bet on the future is carry, and even the authors admit that “the law of carry is the law of the jungle.”

By their definition, a carry trade as one that inherently involves leverage and that makes money when nothing happens. These are financial transactions that produce a regular stream of return, but subject the owner to the risk of sudden loss. In options jargon, entering a carry trade is the equivalent of selling volatility. If nothing happens, you pocket the premium. If all hell breaks loose, you lose your shirt. One of the structural problems with carry trades, as the authors explain repeatedly, is that the longer they last, the more inevitable it becomes that they will crash. The correction is inevitable (or so goes their thinking), because carry trades are self-reinforcing and tend to cause markets to reflect prices that are disconnected with economic reality. Their “somewhat counterintuitive conclusion from this is that the carry regime ultimately weakens the power of central banks. The central bank appears powerful during the carry bubble. … But once the bubble bursts and the carry crash begins, then the central bank is left scrambling.” Of course, if the central bank succeeds in resurrecting the carry trade, then it only serves to make it stronger. This is what happened in December 2008 and again in March 2020. In fact, it’s been happening for decades. But then instead of giving the Fed credit for its swift moves to save the financial system from ruin, the authors warn that “the central bank is merely a captive of the carry regime; it is the vehicle for the broadening and extension of the carry regime and the rent-seeking opportunities that the regime ultimately permits.”

Perhaps because I do not think like a macro-economist, options trader, or regulator, I did not find the implications of a rise in carry to be that bearish. Another reason I worry less than the authors is that I choose to focus on the very micro factors that explain how and why value can compound, even when economies don’t. While I do not disagree that ultimately, we are all exposed to the carry trade and its consequences, unlike the vulnerable traders they describe, I trust that our focus on the end game is what gives us the capacity and fortitude to make it to the proverbial “other side,” regardless of how and when the market imbalances they describe finally corrects. The authors claim that “the wealth that is made by the financial players (and businesses and individuals) who are implementing carry trades is not real wealth of the sort that derives from an economy’s greater ability to produce better goods and services that the general population needs and desires.” … “On the contrary,” they repeat, “it causes financial asset prices to become hopelessly distorted, unhinged from the real economy, and therefore ends up misdirecting scarce capital into potentially unproductive uses.” This may be true in many instances, but certainly not all, and I suspect it overlooks and under-estimates the material improvement in standards of living, prosperity, and technological developments that the carry regime engendered. But more importantly, to me it is less about it being right or wrong and how it may or may not end, and much more about recognizing the phenomenon for what it is. It was only in Chapter 6 that they backed into the more pragmatic implications of their framework by acknowledging that “the Fed acting as a carry trader limits the scale of the carry crash and thereby provides the impetus for an even greater carry bubble to follow.”

The US Fed is not the same as a highly levered commodity or currency trader, or the Central Bank of any other country or block of countries, because they have infinitely more staying power. I accept that one day in the future this will change (since nothing lasts forever), but for as long as the US is the world’s de facto liquidity provider of last resort, and for as long as the dollar remains the world’s primary funding currency – one might argue that the US Fed actually has a moral responsibility to keeping the carry trade alive. Not to bail out just the elite, but the entire world with it. As even the authors conclude, the Fed “is taking us away from a market economy in which risks are borne by individuals and individual businesses and institutions and priced in the market, to an economy in which risks are socialized, or perceived to be socialized.” With the growing prominence of ideas like Modern Monetary Theory (MMT), which the book doesn’t even mention, the socialization of risk seems more likely to be building strength than stalling. Conservatives and liberals disagree on a lot of things, but avoiding crisis isn’t one of them. I try hard not to pass judgement on such trends and ideas – preferring instead to just recognize them for what they are. If financial crisis makes the carry trade stronger, then we shouldn’t be so scared of it. As I have been saying for years, this bull market is more likely to end in [economic] strength, not weakness – so we should be careful what we wish for.

One important conclusion the authors reach is that “the greater liquidity and breadth of financial instruments in the US markets, as well as the dollar’s role as the global reserve currency, has placed the US markets, and specifically the S&P 500 index, at the center of the global carry trade.” Indeed, their narrative for why the S&P 500 carry trade has intensified is persuasive. As they explain in the first half of the book, carry trades play out in many asset classes and transaction types, and these markets, like organisms, can take on a life of their own. ”What the market wants is stronger carry—greater concentration of power and wealth. What the market wants is financial corporatism—large corporations with monopolies or quasi-monopolies and governments and regulatory agencies that are sympathetic to them and implement policy accordingly and with a central banking system that acts to support their share prices. This is the combination that encourages the further growth of carry.”

Indeed, many market participants unknowingly engage in carry trades, such as when emerging market companies borrow in dollars. The authors cite Turkey and Brazil repeatedly as countries that are frequently vulnerable to carry trades (due to their high interest rates), with detailed historic examples of how it ended badly. They basically blame every crisis and mal-investment on carry, which seemed a bit of a stretch, but the discussion helped make it clear why all the world’s rent seekers (as they call the investors who benefit from carry), gravitated towards the S&P 500 after global interest rates converged to near-zero. “Over the years since the financial crisis,” they observe, “the increased moneyness of a broad range of assets has continually driven up equity prices. Corporations—nonbank companies—have been able to issue debt that is perceived by the public as a good substitute for money, the proceeds of which they can use to buy back their own equity.”

My favorite part of the book was when they described “carry” as basically being a euphemism for cumulative advantage. “Carry is the euphemism used in financial markets for power. The mechanism of power is cumulative advantage, and power in its true form is cumulative advantage with no referent—that is, advantage measured along some dimension that is unanchored from any reality other than itself.” They cite the famous Columbia MusicLab experiments that showed how the songs that made the charts were not necessarily the best songs, but the ones that got early social approval (i.e. became famous for being famous). They use this phenomenon to explain why “liquidity is defined as distance from ruin,” and how, the stronger get stronger in a crisis, resulting in greater concentration of power. They repeat Peter Thiel’s claim that the beneficiaries of large cumulative advantages (such as monopolies) rarely admit that they have such advantage. “Like the philosophical joke about the fish who asks ‘what is water?’ the very invisibility of cumulative advantage is the strongest argument for its importance.”

In conclusion, this was a good book with some precious insights on today’s macro backdrop. While I would not necessarily recommend the book for its macro views, it presents a unique framework and contains valuable insights that help one make sense of today’s complex markets. And while the authors may turn out to be right in worrying so much about the end of the carry trade, it is unknowable when that will happen, and is also not clear (to me at least), that it is indeed a zero sum game that needs to end in tears. Regardless, if the authors are even remotely correct in their assessment that asset prices have come unglued from fundamentals, I take comfort in the notion that our investment philosophy applies in spite of the market and its many overlapping carry trades. To paraphrase Munger, long-term investments in growing win-win value propositions is what we do. Carry, is what we deal with.

Best regards,

Adriano

Highlighted Passages:

Chapter 1: Introduction—The Nature of Carry

Carry trades make money when “nothing happens.” In other words, they are financial transactions that produce a regular stream of income or accounting profits, but they subject the owner to the risk of a sudden loss when a particular event occurs or when underlying asset values change substantially.

The classic finance carry trade takes place in the foreign exchange market, when a trader borrows in a low interest rate currency and invests the proceeds in another, higher-yielding currency. If “nothing happens”—that is, the exchange rate does not change adversely or changes by less than the interest rate differential—the trade is profitable. However, when things do happen, when exchange rates or asset prices move against the carry trader, losses can mount suddenly and substantially.

In the view of the authors, these processes and mechanisms have not been recognized or understood properly, even by those economists who focus on the links between power and the distribution of wealth and income.

In this book we define all carry trades to share certain critical features: leverage, liquidity provision, short exposure to volatility, and a “sawtooth” return pattern of small, steady profits punctuated by occasional large losses.

The expansion of carry trades always increases liquidity; the reduction or closing of carry trades leads to liquidity contraction.

This is where the trademark pattern of carry returns plays a role. If a carry crash has not occurred for a substantial period of time, carry trades appear very attractive.

Those that survive are almost always insiders with enough political and financial clout to either influence government policy or react very quickly to it.

Long term, this leads to three critical outcomes. First, it makes prospering in financial markets less about competence and more about insider status, as insiders with weak balance sheets are able to survive carry crashes thanks to central bank action. Second, it reinforces wealth inequality by truncating losses for already wealthy investors who do not necessarily need, but nevertheless benefit from, action to suppress volatility. Last, the distinction between economic recessions and financial market downturns becomes increasingly blurry. Recessions no longer cause severe asset price declines, or bear markets; they are a function of the asset price declines.

We argue that the reality is that the S&P 500 itself has become central to the carry regime in global financial markets; a stock market crash does not signal recession—it is the recession. The cycle of carry bubble and carry crash and the economic cycle have become the same thing.

The rise in asset prices during the carry bubble phase acts to keep deflationary pressures at bay, and then the carry crash manifests as a “deflation shock.” We define this ongoing evolution of the financial structure to be the “carry regime.”

In the limit it becomes more obvious that this must fundamentally be a wealth-destroying process. The wealth that is made by the financial players (and businesses and individuals) who are implementing carry trades is not real wealth of the sort that derives from an economy’s greater ability to produce better goods and services that the general population needs and desires. On the contrary, it causes financial asset prices to become hopelessly distorted, unhinged from the real economy, and therefore ends up misdirecting scarce capital into potentially unproductive uses. Over time, the economy will perform progressively more poorly, with income and wealth more and more concentrated in a few hands.

During the intensely deflationary carry crashes (such as occurred in 2008), they appear to have no option other than to increase moral hazard further, via even greater intervention and bailouts. In one of the various seemingly contradictory aspects of the carry regime, central bankers seem to have enormous power—their extraordinary power to create high-powered money, set short-term interest rates, and strongly influence financial markets with everything they say—but ultimately they themselves have little latitude to act. Central banks become merely the agents of carry. Their seeming immense power is, in reality, mostly illusory.

One conclusion is that the greater liquidity and breadth of financial instruments in the US markets, as well as the dollar’s role as the global reserve currency, has placed the US markets, and specifically the S&P 500 index, at the center of the global carry trade.

Carry by our definition always involves leverage. This means that carry traders either explicitly use borrowed funds or else utilize some set of contracts that creates a potential risk of loss greater than the amount of capital initially employed in the trade.

Chapter 2: Currency Carry Trades and Their Role in the Global Economy

The world of currency markets can be broken down into low interest rate currencies that tend to be “funding currencies”—that is, currencies that are attractive to borrow in to finance carry trades—and high interest rate currencies that are “recipient currencies”—that is, currencies that seem attractive to invest in to benefit from their high interest rates. Over the past 20 years or so, the most important funding currencies have been the US dollar, Japanese yen, Swiss franc, and euro. In recent years important recipient currencies have included the Brazilian real, Australian dollar, Turkish lira, and Chinese renminbi.

If there were a gain to be had from an unhedged carry trade, then it could be achieved more simply by buying the high interest rate currency in the forward market. A positive return from this simple strategy would accrue if the high interest rate currency does not depreciate in line with the expectation priced into the forward exchange rate.

In the latter case the carry trader receives not only the interest rate pickup, or spread, on the currency carry trade but also the benefits from the currency appreciation, giving him a strong positive return from the trade—that is, until the carry crash.

Pure currency carry trades should, in theory, be unprofitable over time if markets are efficiently priced, but the trades can look very profitable if it is believed that central banks will try to slow or prevent currency adjustments that would otherwise occur.

The concept of a currency carry trade is fairly easy to understand in principle. In practice it is often difficult to define whether a particular transaction or financial structure actually constitutes a currency carry trade. If a hedge fund borrows a large sum in a low interest rate currency such as the US dollar or Japanese yen in order to finance a holding of a high interest rate bond such as a Brazilian real or Turkish lira bond, then this is obviously a currency carry trade; it has the classic elements of leverage and the intention to earn a (levered) positive income return from a currency mismatch. But what about the case, for example, of a Brazilian company, operating in a high interest rate currency (Brazilian real), which chooses to borrow in a low interest rate currency, such as US dollars, to finance an investment project that, if successful, could generate some revenues in US dollars and some in Brazilian real? This second case is obviously less clear-cut. To the extent that the project could generate some US dollar revenues, it could be argued that financing in dollars does not constitute a currency carry trade; dollar earnings will be available to service US dollar debt. But what if the dollar earnings end up being disappointing or nonexistent? This example helps illustrate that currency carry trades cannot be identified precisely from data alone; the motivation of the speculator or investor is quite crucial to knowing in reality whether a particular transaction or financial structure is a carry trade or not.

..holding of an asset in one currency with a relatively higher prospective yield is financed by borrowing in a different currency with a lower interest rate. This would encompass, for example, nonfinancial businesses in high interest rate emerging economies financing domestic investment by borrowing in dollars or other lower interest rate currencies. It would not include, though, all cases in which an investor in one country uses her savings to buy an asset in another country and currency to earn a higher yield (Japanese institutions and investors, for instance, have commonly done this). This latter case does have the characteristic of currency risk, which is common to all currency carry trades, but it does not involve leverage. A very important theme we return to later in this book is that carry is closely associated with leverage, and therefore with credit, and with the flip side of credit—debt. At the macroeconomic level, the apparent disregard of currency risk, or perhaps simply willingness to assume currency risk, that is common to currency carry trades will tend to increase demand for credit in the economy for any given interest rate.

…the extent to which the central bank is perceived to be prepared to suppress exchange rate volatility—can have an important influence on demand for credit in the economy.

This would mean that the dollar-funded currency carry trade likely peaked at something close to US$1 trillion in 2007–2008 before collapsing to nearly nothing at the height of the global financial crisis in early 2009, only to explode in size again to reach a new peak toward US$3 trillion in mid-2014.

The interesting thing about the dollar-funded currency carry trade is that the United States is not a natural carry trade funding country because it is a current account deficit economy. In simple terms this means that the United States spends more dollars than its income and thus needs to import capital from outside the country to fill the gap. Dollar carry trade flows involve the exact opposite—capital flowing from the US dollar to fund investment in other currencies.

Since currency carry trades involve credit creation, as the circular flow of dollars expands, global credit is growing.

For example, in the case of Turkey, a US hedge fund might borrow from a domestic bank to finance a purchase of Turkish lira debt securities. This is a pure currency carry trade (given that Turkish interest rates are higher than US rates), and in this case it is associated with an increase in US domestic bank credit. The dollars are sold for lira to buy the debt. If we assume that the Turkish central bank is intervening in the foreign exchange market to prevent the lira rising in value, then the dollars may be acquired by the central bank. The central bank uses the dollars to add to its foreign reserve holdings of US Treasury bills and bonds. So the US Treasury then has the dollars, which finance the US government’s deficit spending. In terms of the US economy, the end result is that bank loans (and therefore money supply) and federal debt have risen; for the Turkish economy, corporate debt and the central bank balance sheet (and therefore money supply) have risen. The end result is the same as if the US government had borrowed from the US bank to finance its deficit, and the Turkish entity’s debt had been bought by the Turkish central bank. The only difference in reality is that the interest rate carry—the higher yield on the Turkish entity’s debt compared with the yield on US Treasuries (with its accompanying increased risk of a crash)—is being picked up by the hedge fund rather than the Turkish central bank. But this counterfactual case in which there is no carry trade would be unlikely to happen. The Turkish central bank would be unlikely, in normal circumstances, to buy a Turkish corporate debt security. The US Treasury would not finance its deficit by borrowing directly from a bank. The existence of the currency carry trade—the hedge fund’s willingness, in the example, to assume that the lira will not decline by as much as the interest rate differential over the life of the investment—encourages a greater increase in bank credit and money supply than would otherwise be likely to occur.

The “mispricing of risk”—the assumption that the lira will not depreciate in line with the interest rate differential—results in greater credit and money creation than would otherwise be the case.

Greenwich, Connecticut–based giant hedge fund LTCM pioneered the use of complex mathematical models to extract supernormal returns from highly levered carry, or volatility-selling, bets. The culmination of the carry crash in 1998 saw LTCM collapse, threatening—at least in the eyes of central banks—global financial markets as a whole.

In what must be considered a pivotal moment in the rise of carry, Federal Reserve chairman Alan Greenspan directly expressed his concerns about the sharp widening of credit spreads that marked the 1998 carry crash and implemented a surprise rapid easing of US monetary policy that featured three consecutive interest rate cuts within two months, over September to November 1998. The US economy at the time was very strong and in no way justified cuts in interest rates from what were already quite low levels. By doing this, the Fed, for the first time, made explicit that it viewed the stability of financial markets and, in particular, the level of credit spreads to be an express responsibility and priority of the central bank. That action has colored all market behavior since and laid the groundwork for successively bigger carry bubbles. The knowledge that the Fed and, by influence, other central banks stand behind them has made carry traders more confident in their levered bets on low financial volatility.

The role of the yen carry trade in the global credit bubble that preceded the crisis and the role of its unwinding in the subsequent global meltdown have been severely underestimated or ignored entirely by most subsequent analysis and commentary.

Despite the Bank of Japan’s adoption of quantitative easing policies and much talk in the financial markets about the yen carry trade, there was little evidence to suggest that the yen-funded carry trade had been resurrected back to its former heights. Instead, it seems likely that the European Central Bank’s conversion to the central bank trend of zero interest rates and quantitative easing promoted the development of a euro-funded carry trade during 2013 and 2014. Certainly, there was substantial growth in the net foreign assets of German, Dutch, and Spanish banks over this period, which provides strong circumstantial evidence of a growing euro-funded carry trade. So by mid-2014 the dollar-funded carry trade was dominant, but there was a significant euro-funded carry trade and probably a small yen-funded trade. What remained of the Swiss franc–funded carry trade blew up on January 15, 2015, taking a number of small financial institutions and currency traders with it, when the Swiss central bank announced that it would no longer cap the Swiss franc’s exchange rate against the euro.

Chapter 3: Carry, Leverage, and Credit

A problem that is rarely appreciated is that when carry trades become prevalent in any financial market, it becomes virtually inevitable that they will crash.

A currency carry trade involves an implicit bet on the exchange rate for the borrowed currency in terms of the currency of investment remaining relatively stable. Even for the most attractive of currency carry trades, a large adverse move in the currency exchange rate can easily wipe out the interest rate spread. So the currency carry trade is, in essence, a bet on the exchange rate volatility being low, at least relative to what the market might expect. It can therefore be thought of as a “volatility-selling” trade—a bet on volatility declining or at least being low relative to market expectations.

An obvious problem occurs if the period of positive returns from carry lasts “too long,” meaning that excessive amounts of capital will tend to be attracted into the carry trade to earn those abnormal returns. If this happens, it means that the risks are being mispriced.

Thus central banks’ “success” in the short term in terms of stabilizing markets encourages further growth in carry trading, which in turn builds up even greater risks for the long term.

To the extent that the data are indicative of the relative size of the carry flows for each country, they suggest that the most important carry recipient economies in recent times have included China, Australia, Brazil, Turkey, India, and Indonesia.

The lesson here, though, is that a fully global carry bubble cannot really be sustainable for long based on only one pillar, even if that one pillar is volatility selling in the US financial markets, the most important of the world’s financial markets. A giant and longer-lasting carry bubble needs to feed through into credit growth in different areas of the world; if there is a longer-lasting carry bubble, there will be a visible credit bubble.

When the dollar value of GDP is so much higher, it makes these ratios look better—until the currency collapses in the carry crash, and then they suddenly look very much worse. But by then it is too late for any investor who has taken these kinds of indicators too seriously.

Chapter 4: Dimensions of Carry and Its Profitability as an Investment Strategy

The opportunity for profit in developed country currency carry has shrunk considerably over the last 40 years and is at an all-time low in recent years.

Because the losses tend to occur during “bad” times, central banks often respond with stabilizing actions. This has the effect of truncating carry losses generally and, more granularly, concentrating those losses in the least sophisticated areas of the markets.

This combination of a solid IR but low absolute returns presents asset managers with a conundrum. The risk-return trade-off appears good, but the strategy does not generate high enough levels of absolute returns. The “solution” is often to apply more leverage. This can generate higher absolute returns but, of course, comes with the trade-off of potentially much higher risk.

However, if we take the risk management perspective, what can be said is that there is a meaningful chance that poor results in a carry portfolio will occur when other asset markets are also performing poorly, which means carry strategies amplify rather than reduce the risks of most financial portfolios.

But financial markets have become increasingly complex, and carry trades—volatility-selling trades—can be implemented in all the various markets: stock markets, credit markets, commodities markets, even housing markets, as well as currency markets.

it is possible, for example, for carry trades in the commodities markets to be crashing even as the S&P 500 carry trade is expanding—at least for a period.

the evidence presented does show that when currency carry strategies perform poorly, stock market volatility tends to spike.

The empirical evidence is that as the S&P 500 becomes more central to financial markets, its volatility is important to all carry strategies, which means future carry unwinds will likely be correlated to a greater extent across asset classes. This is a very important point, which is central to the discussion later in this book.

Experience in Brazil over the past few years also broadly fits this pattern. Brazil has been a major carry trade recipient and therefore a prime candidate for the dynamic we have described. Its currency began turning against the dollar in late 2014, and this depreciation eventually turned into a collapse. The Brazilian real lost over 20 percent of its value against the dollar in just two months in early 2015 and fell again by over 25 percent during a similar window that summer. Since carry trades now play an important role in credit creation, we can expect carry crashes to trigger more severe downturns in the real economy than we have seen in the past. Again, Brazil and Turkey serve as warnings: Brazil’s economy was in recession every quarter through 2015 and 2016, shrinking by 8 percent in total over those two years. Turkey’s fate is likely to be similar.

Chapter 5: The Agents of Carry

It is therefore no accident that the increased involvement of central banks as lenders of last resort has coincided with the growth of carry. They are intimately linked.

It is not possible to understand the business cycle, the behavior of the global economy, without understanding carry.

We have described carry trading as a strategy that makes money as long as “nothing happens.”

Institutions that report returns over short time horizons have an incentive to gravitate toward carry strategies because they will be regularly reporting profits. It is much easier psychologically to have a trading book with carry-like attributes reporting frequent small gains and occasional large losses than having constantly to explain small losses with the promise of a big gain in the future.

Thus, the mechanics of managing a levered portfolio create a strong incentive toward being long carry.

If traders or portfolio managers are paid cash bonuses based on quarterly or annual profit and loss—and that compensation is not returned if their book subsequently loses money—they will strongly prefer strategies with carry-like cash flows.

In short, many carry trades are not attractive without the use of high levels of leverage, and anyone employing leverage is unlikely to want to be short carry (long volatility) in the first place.

While their liability profile argues against carry, their compensation structure creates a strong incentive in the opposite direction. Each year hedge funds collect a share of the accounting gains as a profit share—historically this has been 20 percent. A strategy that has steady accounting gains for four years and then suffers a loss in year five will still yield four years’ worth of profit share—payments that are not given back even if the losses in year five wipe out previous gains. Given this reporting and fee structure, it makes sense that hedge funds would gravitate toward strategies with carry-like payouts.

Virtually all hedge funds employ leverage, although there are huge variations in the amounts of leverage used across firms. This again creates a bias for hedge funds to employ carry strategies.

The industry is no longer tiny. HFR now estimates that by the end of 2018 hedge fund assets under management (AUM) were US$3.1 trillion, a 25-fold increase from 1996. By comparison global stock market capitalization has roughly tripled over that same period. Moreover, the influence of hedge funds is magnified by two additional factors: leverage and trading frequency.

Trading frequency acts like leverage in that it also magnifies the market impact of the securities under a hedge fund’s control. A portfolio of securities traded very actively hits the market frequently—impacting prices and liquidity. A hedge fund that turns its holdings over every month will end the year having owned 12 separate portfolios. In terms of its impact on prices, this fund could have 10 or 20 times the impact of a more traditional fund that looks to hold securities for multiple years. This combination of leverage and frequent trading makes hedge funds even more influential than their headline AUM would suggest. If this headline AUM has grown by 25 times in the last two decades, then hedge fund influence on markets has increased by an even greater magnitude.

Since it faces no pressure to sell assets during bad times, the Norwegian fund is well placed to invest in carry strategies. Indeed, it commissioned three well-known finance academics to write a report about its management, and they explicitly cited the nature of the fund’s liabilities as something that should drive its investment strategy. One of the strategies they suggested that fits this profile was foreign exchange carry.

Since 2014, the scale of investment bank proprietary trading has been reduced. Anecdotal evidence suggests that many proprietary trading groups have simply joined hedge funds. Others suggest that “prop” positions are still present but better hidden within other allowable parts of banks’ books. These claims are not easily verified. Given the Volcker Rule and the increased regulatory focus on systemic risk, it seems unlikely that banks have been a meaningful source of carry growth in the last several years, and this is not likely to change.

Researchers at AQR Capital suggest that reported betas of private equity funds (essentially the correlation of private equity returns with public market returns), even after adjusting for potential smoothing, are less than 1.0.4

Short-lived market corrections—such as the almost 10 percent decline in the S&P 500 in December 2018—might barely be reflected in a private equity portfolio’s return.

In the latter chapters of the book, we also talk about a further, political-societal feature of carry as being a strategy that primarily benefits insiders—the wealthy and politically connected. Private equity certainly ticks this box as well. Regular people cannot invest in private equity, only the very wealthy and institutions. Even among those with the capital to invest in private equity, only a few can have access to the most successful managers. The value extracted by private equity fees and the returns earned by private equity funds are mostly the preserve of insiders.5

For instance, according to Bain and Company, which produces a detailed overview of the industry each year, the last five years have been the strongest in the industry’s history, and there were US$582 billion in global buyout deals in 2018 alone.6 This is virtually the same size as the combined deals over the period 1995–2002. Private equity has been an important component in the rise of carry.

We would argue that profit share in the economy itself has become a function of carry. (We discuss this further in Chapter 8.) But whether or not one accepts this, it seems evident that corporates taking advantage of very low interest rates on their own debt to finance higher-yielding financial investments—whether these businesses are non-US companies borrowing in dollars to buy higher-yielding domestic currency assets or US corporates borrowing at low interest rates to buy back their own equity—are themselves engaging in carry trades. It may even be plausible to argue that nonfinancial corporates have been the single most important economic sector driving carry trades in the post-crisis period.

The Transformation of Global Financial Markets The global financial markets have been transformed in the last two decades. Hedge funds have evolved from tiny niche overseers of private wealth to giant institutional asset managers. Sovereign wealth funds have grown into a global force looking after long-duration pools of capital accumulated by government entities. Both types of institutions have incentives to engage in carry. Finally, there is evidence from corporate balance sheets that emerging market companies are using their access to international capital markets to engage in carry-like activities of their own, while the corporate sector broadly has been increasing leverage. Together the activity of these institutions and businesses has been an important driver of the structural growth in carry. Until and unless an ultimate carry crash changes their incentives, we expect this growth to continue.

It might not be too much of a stretch to conclude that HFTs, with their extreme frequency of trading and with operations in the US equity markets at the center of the global carry trade, are an important part of the machinery of the carry regime. Their rise is perhaps another marker, in institutional terms, of the rise of carry.

But central to the rise of carry are the institutions that have been the most influential carry traders of all—the central banks. The central banks are the ultimate agents of carry, now with large balance sheets that themselves constitute a giant carry trade. We explore the crucial role of central banks in the rise of carry much further in the remaining chapters of the book.

Chapter 6: The Fundamental Nature of the Carry Regime

When is a dollar most valuable? Standard economic models focus on “consumption utility”: the utility of that dollar in the real world. According to these models, an extra dollar is especially valuable when economies are shrinking; when commodity prices are rising; when a person is hungry and cold; when a person really needs that dollar—to feed himself, warm himself, shelter himself; when he needs that dollar to save his life. This is a reasonable perspective.

We discuss how this has made S&P 500 volatility, as proxied by the VIX, the central risk factor in global markets.

The authors define a carry regime to be a structure of financial market pricing and a pattern of market behavior that, over time, rewards those implementing carry trades with outsized returns. Those outsized returns, if expressed as a total return index for a carry investment, will take the form of a usually steady ratcheting higher of the total return index—punctuated by severe carry crashes.

…the important influence that central banks (and the IMF) have had in encouraging the growth of carry trades, along with the instability that this has engendered, is quite obvious.

In expectation, therefore, the writer of the option will make money if volatility is lower than expected; she is “selling volatility.”

The simplest example is running constant leverage. Given that the carry regime is fundamentally about leverage, this is an important concept. For example, say an investor or speculator wants to be 200 percent levered long the S&P 500 at all times. Say he has $100 of equity and therefore a $200 total position. If the market immediately rallies 1 percent, his position goes to $202 and his equity goes to $102. Since $202 divided by $102 is less than 200 percent, he needs to buy $2 more in order to maintain constant 200 percent leverage. If instead the market falls 1 percent, his position goes to $198 and his equity goes to $98. In this case his position is now greater than 200 percent; he needs to sell $2 of stock in order to maintain his constant level of leverage.

A levered speculator, trading with the market, is buying optionality. She has the potential to make explosive profits if the market keeps moving in her favor, and she continues trading with it. In return for this potential, she will always find herself buying higher and selling lower around the fluctuations—the noise—in market movements, and every time she trades, there is a cost. It is easy to see that the total cost of trading with the market is related to the volatility of the asset price; the more the asset moves up and down, the more trades are required and the higher the cost. In expectation, the activity of trading with the market costs an amount directly proportional to volatility squared, or variance. (This is sometimes referred to as “volatility drag” or “variance drag.”)

Getting stopped out, in this manner, of a levered long position means selling when the price falls; getting stopped out of a short position means buying when the price rises. Getting stopped out is always trading with the market. The expected value of the cost of trading with the market should be the same whether a speculator chooses to pay it explicitly by rebalancing or by accepting the risk of ruin.

In practice, the speculator’s situation is further complicated by the fact that the point at which she can get stopped out changes, depending on overall financial conditions and her broker’s own financial position. For example, in August 2007 speculators could lever a position in US high-yield credit as much as 10 times. One year later the maximum levered position was reduced to 4 times. Levered speculators in CDOs of asset-backed securities fared worse: in August 2007 a position in the highest-rated tranche of a CDO could be levered by 25 times; by August 2008 almost no leverage was available at all.5

In every kind of short volatility trade, the return is collected by receiving the more certain amount and preparing to pay an uncertain amount. For instance, in the VIX roll-down trade described earlier, the carry trader sells long-dated implied volatility at a known price and will close out the trade by purchasing the spot VIX in the future at an uncertain price.

Heavy volatility selling in the S&P 500 turns the S&P 500 itself into a carry trade.

…the thing that matters most is what might be called “covariance with bad times.”

If S&P 500 volatility has become “global volatility,” then it represents generic liquidity risk—the risk that defines the value of money. This must be the best-paying risk in the world. At the same time, this absorption of the generic liquidity risk premium must convert the S&P 500 itself into an extreme carry trade, with high expected returns and terrifying skew. The chance of all-but-zero-probability events, such as flash crashes or October 1987s, rises, from all but zero, to something meaningful.

With the advent of quantitative easing (QE), particularly in its open-ended form, QE3, which was announced in September 2012, the Federal Reserve became very active in providing liquidity and leverage—which is to say, effectively selling volatility in staggering amounts.

We would suggest that the true explanation of why the S&P 500 rose so strongly in the wake of extreme quantitative easing is subtly different. The idea that the stock market rose so much over 2013–2014 purely because the Fed pumped so much money into the economy is not credible. If the markets were really inflated by the Fed’s extreme money creation, then prices of commodities, goods and services, and wages would have risen eventually also. Instead, commodity prices were broadly weak over the period, and the gold price, often considered an indicator of monetary inflation, was markedly weak. Rather than inflation, there were persistent fears of the risk of deflation. To believe that Federal Reserve money creation can drive up equity prices, but not drive up other prices, is to believe that the Fed can create real wealth. And it seems implausible that the Fed could create real wealth, at least not on a permanent basis—basic economics or simple common sense tells us this. The true reason that the US stock market rose is that the S&P 500 has become a carry trade and the Fed’s QE policy represented a massive selling of volatility. The Fed became possibly the biggest carry trader of all: its balance sheet is a huge carry trade with large holdings of yielding securities, such as Treasury securities and mortgage-backed securities, financed by very low-cost liabilities including zero-interest cost cash currency in circulation.

However, in the short term, as that extra supply is put to work in the markets, the realized return to carry increases. The carry regime then emerges as a series of carry bubbles and carry busts—successively larger bubbles and busts as central bank intervention increases progressively in each cycle—more than merely an equilibrium process arising from the world’s need for liquidity.

These different kinds of Fed interventions all fit together: the notions of the Fed as a seller of volatility, as a carry trader, and as a creator of moral hazard are different ways of viewing the same phenomenon. The Fed acting as a carry trader limits the scale of the carry crash and thereby provides the impetus for an even greater carry bubble to follow.

Chapter 7: The Monetary Ramifications of the Carry Regime

It meant that there was a very large effective increase in the money supply, which is why outright severe deflation did not occur, at least initially.

Over the years since the financial crisis, the increased moneyness of a broad range of assets has continually driven up equity prices. Corporations—nonbank companies—have been able to issue debt that is perceived by the public as a good substitute for money, the proceeds of which they can use to buy back their own equity. Through that process the public swaps equity for “money,” while equity prices are driven up. This means that nonbank companies seem to become more like banks—levered entities that have monetary liabilities—at least until the point of the carry crash.

We have introduced the question of whether carry regimes are a natural outcome of a free market economic system or whether they are a function of policies implemented by central banks and other government institutions. Our answer is that carry is a naturally occurring phenomenon, but the specific carry regime that has developed in global financial markets over at least the past two decades is the result of the “supercharging” of this natural phenomenon by central banks, particularly the US Federal Reserve.

This would tend to suggest that the carry regime is unstable and must ultimately destroy itself.

The paradox is that although today’s global carry regime could be viewed as a product of central bank policies and therefore a manifestation of the enormous power of central banks, the monetary effects of the carry regime actually severely weaken the power of central banks. The US Federal Reserve was legislated into existence in the early twentieth century in an attempt to end repeated financial crises. Could impotence in the face of repeated carry crashes lead its authority to be legislated away in the twenty-first century?

We argue in Chapter 10 that it is possible to imagine an anti-carry regime. The fact that this is possible means that the carry regime—at least in its present form—is not something that can be taken for granted, something that always must exist. It could end, and if it were to end, the demise of central banking might be inextricably tied up with that eventuality.

Because some classes of monetary asset—balances in checking accounts, for instance—are clearly closer to the pure definition of money than others, there are different statistical measures of money supply. The narrowest measure, M1, includes the forms of money that can be used to pay for things directly—cash and checking account balances—while broader measures, such as M3, include those forms of money such as longer-term time deposits that, from the point of view of the holder, are available to pay for things but not immediately.

The central bank can boost the total of the reserve balances—basically the purest form of liquidity, the “high-powered money” that the banks hold—by lending to banks (against collateral) or buying assets from banks or from the rest of the private sector. If the central bank buys assets from companies or individuals—as part of quantitative easing, for instance—then that boosts banks’ reserve holdings and also increases the money supply directly.

This suggests that in a carry regime, in which the volatility of asset prices is suppressed and eventually becomes very low, a greater range of financial assets will begin to appear more money-like; they will come to seem as good as money. As the carry regime broadens, encompassing more financial assets—bringing down their yields and reducing their price volatility—then the effective supply of money, in terms of what the holders of the assets perceive to be money, will be growing. One way to describe this is to say that “moneyness” is growing, even though the supply of money under the traditional measures of money may not be.

In 2008, at the height of the financial crisis, the US government introduced a temporary guarantee for money market funds. In Europe, at the height of the euro area crisis, the European Central Bank announced its “whatever it takes” approach, interpreted as a statement of preparedness to guarantee the values of peripheral European government debt. These and all the other post–crisis and “experimental” monetary policy measures could be argued to have increased the moneyness of a whole range of financial assets.

The paradox is that the central bank is only able to do this because its power to create money is a great power, but the use of this power in this way actually serves to undermine its power. Its control over the total extent of moneyness is weakened.

What gold bugs did not understand was that these policies guaranteed, or more correctly seemed to guarantee, the values of nonmonetary financial assets, which hugely extended the carry regime. Over the long run the carry regime is fundamentally deflationary and not inflationary.

Contrary to the popular Keynesian view, the global problem has not been too much savings but, in general, too little savings and too much debt. Some economies—most obviously China’s—have had too much savings, but much of that savings ends up being wasted in unproductive investments. The global problem is that too little savings and misallocated resources mean that trend economic growth is very low. This further causes interest rates to be very low. It also means that debt burdens are barely sustainable, or clearly unsustainable in some cases.

In fact, put in conventional terms, it is taking us away from a market economy in which risks are borne by individuals and individual businesses and institutions and priced in the market, to an economy in which risks are socialized, or perceived to be socialized.

This means that in a carry regime, which is associated with long-term pressure toward deflation, the demand to hold money will have a tendency to be strong over time (even as the demand for “true money” is weak during the carry bubbles). People and businesses will, in general, wish to hold quite a high proportion of their assets in the form of money and will also be comfortable holding money in high proportion to their incomes. From an economist’s point of view, this is the same as saying that the velocity of circulation of money will be low and declining; a greater proportion of the money stock will be held as a form in which to hold savings. However, the chart in Figure 7.1 shows that as the US economy and financial system have developed into a carry regime over the past 20 to 30 years, the demand for money—in the traditional sense—has not been strong. As a proportion of total financial assets, US households have held comparatively little money (cash currency and bank deposits). In particular, during the intense carry bubble periods of the 1990s, 2003–2007, and 2009 onward, money held by households as a proportion of total financial assets declined markedly.

The true answer is that households are not perceiving equities and mutual funds to be particularly risky. They increasingly have perceived financial assets other than money, including equities, to be the responsibility of the central bank or government, in a similar way to money. If the stock market goes down by a large amount, the Federal Reserve will do whatever is necessary to rescue it. And after all, it can print money. This is what they believe.

The money supply may be growing, but once the carry crash occurs, the true money supply will be deficient. The inflation rate may have been at a comfortable level in the low single figures, but that can turn negative very quickly indeed in the carry crash. To repeat our statement from earlier in the book—a stock market crash does not signal recession; it is the recession. The cycle of carry bubble and carry crash and the economic cycle have become the same thing.

Our somewhat counterintuitive conclusion from this is that the carry regime ultimately weakens the power of central banks. The central bank appears powerful during the carry bubble. Hints from the central bank that it is supportive of the economy and the financial markets easily help to grow the carry bubble further, and further create the sense of an all-powerful central bank. But once the bubble bursts and the carry crash begins, then the central bank is left scrambling. If the central bank succeeds in resurrecting the carry bubble, and hence broadening the carry regime further—as central banks finally did in 2009—then the illusion of central bank power can be restored, probably to an even greater extent than before. But really, more than being in control of it, the central bank is merely a captive of the carry regime; it is the vehicle for the broadening and extension of the carry regime and the rent-seeking opportunities that the regime ultimately permits.

Chapter 8: Carry, Financial Bubbles, and the Business Cycle

Furthermore, attempting to predict the shocks requires a different forecasting approach from those used by conventional economists.

In global financial markets, strong carry bubbles developed over the periods 1993–1997, 1999–2000, 2003–2007, 2009–2011, and 2012 onward. Clearly identifiable carry crashes occurred in 1998, 2000, and 2008. Minor carry crashes, or corrections, also occurred in 2011, 2015, and 2018. The 2011 carry crash was probably limited by the impact of the US Federal Reserve, which was aggressively implementing quantitative easing policies at that time.

(for example, debt instruments and exchange-traded funds composed of debt instruments).

Nevertheless, unlike with currency carry trades or the stock market, there are no central banks that make it their business to support oil prices. There are governments—such as the Saudi government—that provide support, but the constraints under which they operate are much greater. Because of this we should expect an oil carry trade to be more vulnerable and short-lived, compared with a stock market or currency carry trade. Without the direct interference of central banks in the market, the oil carry trade merely delays somewhat the inevitable market price adjustment.

During the time when the price was ratcheting higher, from late 2007 through early 2008 and again from early 2013 through mid-2014, the spread between the fourth contract and the first contract was negative—that is, the market was in backwardation—and it did not turn positive again (contango) until the price had fallen sharply.

Most people would argue that oil is different from other commodities because oil is an important part of the economy’s costs, it is an important part of consumer expenditure, and it is essential. This makes no difference. All that matters is whether the oil price was a bubble or not.

All the asset bubbles can be identified as having their origin in carry, but no two bubbles have been identical. Furthermore, as the carry regime has progressed, each successive bubble is larger than the last. But this is certainly not apparent to most observers and participants, whether professional investors or financial commentators.

Wall Street argues that equities are not in a bubble because price/earnings ratios are not unduly high, ignoring the reality that corporate profits themselves are a function of the carry bubble.

Chapter 9: The Foundation of Carry in the Structure of Volatility

Conversely, a speculator who wants to sell an option can replicate the payoff from writing a call by trading in the exact opposite way—by trading against the market. Trading against the market is selling optionality. In trading against the market, the speculator continually adds to losing positions: buying as the price falls, selling as it goes up. Historically, as explained in Chapter 6, volatility has been better to sell than to buy; it is systematically expensive. That is, there appears to be a risk premium—a positive expected return above the risk-free interest rate—to selling volatility. In particular, there has been an extremely pronounced and rich risk premium to selling US stock market volatility. This is important in understanding the nature of the global carry regime.

The observation that daily volatility exceeds monthly volatility implies that returns are mean reverting. Large short-term moves in one direction are likely to reverse partially over longer horizons. What is the most direct way to exploit this property? Selling optionality involves trading against the market.

Every trader today has come to know that buying the dip is a profitable activity. Why should it be profitable? One perspective is that the dip buyer is providing needed liquidity. Because a falling market makes traders want to sell or need to sell. A falling market makes traders willing to pay in order to sell. (“Get me out” is the cry of some traders—sometimes with a swear word included to add some extra urgency.) This is consistent with the marginal trader holding a levered position and therefore needing to buy—being willing to pay a premium to buy—optionality. What is the risk in buying the dip? The risk here is that there is a very large downside monthly return compared with the volatility of daily returns. The risk is that the market keeps falling, without bounces; that downside returns become serially correlated. The risk is that the market briefly enters a state in which, instead of declines being likely to reverse partially over longer horizons, declines now cause further declines. This, of course, is exactly what happens when leverage dries up in a carry crash.

Every trader today has come to know that buying the dip is a profitable activity. Why should it be profitable? One perspective is that the dip buyer is providing needed liquidity. Because a falling market makes traders want to sell or need to sell. A falling market makes traders willing to pay in order to sell. (“Get me out” is the cry of some traders—sometimes with a swear word included to add some extra urgency.) This is consistent with the marginal trader holding a levered position and therefore needing to buy—being willing to pay a premium to buy—optionality. What is the risk in buying the dip? The risk here is that there is a very large downside monthly return compared with the volatility of daily returns. The risk is that the market keeps falling, without bounces; that downside returns become serially correlated. The risk is that the market briefly enters a state in which, instead of declines being likely to reverse partially over longer horizons, declines now cause further declines. This, of course, is exactly what happens when leverage dries up in a carry crash.

Chapter 10: Does the Carry Regime Have to Exist?

The heart of this chapter lays out a series of thought experiments, from both volatility and monetary perspectives, which demonstrate that the carry regime is intimately linked to deflationary pressures and that an inflationary world would necessarily reverse many of its key features. These thought experiments are quite abstract and may be somewhat difficult to comprehend at first. They are not intended to forecast likely futures for the world, and in particular they are not intended to portray likely futures for the structure of volatility of the S&P 500. Indeed, it seems more likely that the end of the carry regime, or the birth of an anti-carry regime, would be associated with the receding importance of financial markets. Relatedly, it may be more likely still that, before its end, the carry regime will mutate into new forms not centered on the S&P 500. Plausible future focuses of the carry regime might include Chinese stock markets, global property markets, or, especially, equity-bond correlation. The point of the thought experiments is rather the insights they can provide into the nature of the present carry regime.

This combination will also mean that the demand to hold money (in all its potential forms)—relative to income—will tend to be quite high. In itself, other things being equal, this will exert pressure toward deflation. If deflation is not to happen, money growth will need to be reasonably high, at least higher than average. Given that the demand for bank credit is likely to be fairly weak, there are two ways that higher-than-average money growth can be achieved. One way is via direct central bank actions. The second way is if nonmonetary financial assets come to be considered as good, or even perfect, substitutes for money. In practice, this second way is likely to require central banks to take responsibility (at least to some degree) for these nonmonetary assets—that is, practically, to treat them as contingent liabilities of the central bank.

If carry is to fail and volatility buyers are to be paid, then volatility must simply be rising over time faster than the upward slope of the implied volatility curve. This is the true anti-carry regime, where market “expectations” systematically underestimate future change. All of this would be consistent with a completely uncontrolled hyperinflationary spiral. This is the world in which money dies.

A mirror opposite of the carry regime is unlikely to be different. The equivalent of the carry crash in a simple mirror-image anti-carry regime is a collapse in the value of money with inflation spiraling out of control. Would it be likely that a poor person would benefit from such an eventuality? Obviously, it would not. In general, whether in a carry regime or a simple anti-carry regime, it will be those with the greatest resources that will ultimately come out of the dislocations relatively better off. This brings us to a simple truth. At the heart of the carry regime or the hypothetical anti-carry regime lies monetary instability. It is the fundamental instability of fiat money—the fact that the problem of money has not yet been solved—that leads to the emergence of the carry regime in financial markets. In any society some will have more power and command over resources, and some will have less. What fiat money does is allow this imbalance of power to manifest directly in the financial and economic world. The way it does this is through the development of the carry regime.

If the financial system becomes entirely dominated by carry, then it will no longer be contributing to productivity growth. As resources in the economy are devoted increasingly to carry, then genuine investment in the economy—in productive assets other than the service of liquidity provision—will decay, ultimately to zero, as will genuine economic growth. The carry regime—the process of carry bubbles and then crashes that wipe out carry traders with fewer resources—will be associated with a relentless increase in income and wealth inequality. It remains a subject for debate whether the blame for this can be laid at the doors of the leading central bankers of recent years or whether the fundamental nature of carry makes it inevitable that a fiat money system will evolve into a carry regime regardless of who is leading the central banks. But it is clear that central banks have been agents for the transmission of carry into the explosion of inequality that we have experienced. If we aspire to create economies in which all can participate and prosper, then the framework in which central banks operate, both legal and intellectual, will have to be greatly altered—and this likely applies also to other agencies of government and multilateral agencies (such as the IMF) that participate in bailouts and otherwise involve themselves in financial markets.

Chapter 11: Carry is Synonymous with Power

In short, the law of carry is the law of the jungle, “red in tooth and claw,” and we are always in the jungle.

Carry, in short, is a flow from the weak to the strong; from the needy to the needless; from those who have no choice to those who do. Entities that have excess liquidity with which to take risk will lend it, receive carry, and so gain more excess liquidity. Entities that lack liquidity, need liquidity, and must borrow for it, will pay carry and so become more lacking and more needy. As in the Gospel of St. Matthew: “For unto every one that hath shall be given, and he shall have abundance: but from him that hath not shall be taken even that which he hath.”

Financial instruments, too, can be viewed as communications standards that have network effects. As mentioned in Chapter 10, while the centrality of the S&P 500 to global markets today is quite reasonable, it was not predestined and may not be eternal. So, ultimately, even today’s convergence of the financial carry trade onto the S&P 500 and the VIX is an example of cumulative advantage at work.

Like the philosophical joke about the fish who asks “What is water?” the very invisibility of cumulative advantage is the strongest argument for its importance.

Analogously, we believe that financial markets with strong cumulative advantage effects are not particularly likely to allocate resources optimally. At the highest level, this is the thrust of our argument against the growing carry regime in modern financial markets.

Carry Is Power The point is this: “Carry” is the euphemism used in financial markets for power. The mechanism of power is cumulative advantage, and power in its true form is cumulative advantage with no referent—that is, advantage measured along some dimension that is unanchored from any reality other than itself. (Beauty is not wholly unanchored, nor is singing or acting talent; “famous for being famous,” however, is.) Power must exist as long as risk exists: it is the capacity to withstand risk (and survive), and it is the capacity to take risk (and prosper). In other words, it is optionality. It is inevitable, it is necessary, and it is the motor for the emergence of complexity—life, consciousness, civilization—in the universe. However, the rise of what we have called the carry regime necessarily means a progressive de-anchoring of the structure of market prices from fundamental economic reality (since self-sustaining de-anchoring from fundamentals is what pure power is). Over the very long run, this de-anchoring weakens growth and increases economic risk. Monetary policy has—likely at first inadvertently—promoted this de-anchoring and finally is being captured by it. This de-anchoring, invisible though it may be, is having increasingly corrosive effects on the political environment and social fabric across the developed world. In short, power, inevitable though it may be, should not be encouraged to grow too strong.

Chapter 12: The Globalization of Carry

In the context of evolution, a species “wants” to survive and reproduce. It develops a set of physical and behavioral traits that aim to maximize its fitness for a certain environment, but that environment itself changes—mostly gradually but occasionally abruptly. Thus, there is a continual feedback loop of local adaptation and environmental change. When we think of a financial market not merely as a neutral hub for the effecting of transactions but as an evolving network that has its own structure, then it might also be reasonable to think about what the market wants.

What the market wants is stronger carry—greater concentration of power and wealth. What the market wants is financial corporatism—large corporations with monopolies or quasi-monopolies and governments and regulatory agencies that are sympathetic to them and implement policy accordingly and with a central banking system that acts to support their share prices. This is the combination that encourages the further growth of carry.

The Globalization of Moral Hazard In Chapter 7 we discussed how the carry regime in global financial markets is ultimately associated with a convergence of economic growth and interest rates toward zero—a “vanishing point,” as we termed it. In Chapter 9 we argued that the S&P 500, because of its great liquidity and depth of derivatives markets, must be a carry trade that stands at the center of the global carry regime. It is a small step from those insights to recognize that as the convergence toward the vanishing point takes place, there will be a simultaneous convergence of the carry trade on one carry instrument—the S&P 500 itself.

To illustrate, we can return to an example used earlier in the book, of a hypothetical Brazilian company that has borrowed dollars to finance a domestic investment. Imagine that at the time the funding matures and has to be refinanced, there is a global carry crash; carry trades are being unwound, and the Brazilian currency, the real, plunges against the dollar. In these circumstances it is likely to be difficult for the Brazilian company to refinance its dollar borrowing on terms that are not punitive. This is where liquidity swaps come in. The Brazilian central bank gives access to dollar funding to a Brazilian bank to refinance the company’s debt, and the central bank in turn acquires these dollars via a liquidity swap with the Fed.

The carry regime is not some abstract idea; it becomes the way that people think. Interventionist central bank and government policies have been crucial to the development of the carry regime; they seem to “work” in the carry regime. So interventionism then becomes mainstream thinking in economics. It has become conventional wisdom, for instance, to believe that it is the job of central banks to respond to volatility in the financial markets. So the longer the carry regime lasts, the more that the intellectual—and policy—climate adapts to accommodate it.

The carry regime contributes to the S&P 500 looking expensive, but it also contributes to low real interest rates. Many market participants look at zero or negative real yields on bonds and conclude that equities are at least attractive in relative terms. Cash suffers from the same comparison. Real cash yields have been zero or negative for most of the decade since the 2008 crisis, making equities superficially seem attractive on a relative basis. In addition, for professional money managers whose pay and employment are a function of the money managers’ performance relative to the market, holding cash is profoundly risky. Thus it becomes exceptionally difficult for them not to participate in the asset bubbles created by a carry regime. Indeed, it may be quite rational for most investors to keep buying into the bubble; it is version 2.0 of the old (and now almost quaint-sounding) Wall Street saying that “no one gets fired for buying IBM.” No one gets fired for being long the S&P 500. After all, in a crash not only is there an expectation that the central bank will intervene, but also virtually all investors will be suffering as well, and so no institution is likely to be singled out as having made poor decisions. Furthermore, if the carry regime ultimately continues, and if the carry crash is followed by a new carry bubble, those carry traders with enough resources to survive the carry crash will prosper anew, accumulating even greater wealth. The general pattern is that the carry crash will wipe out latecomers to the carry bubble— those who jumped on the bandwagon too late or those with insufficient resources to survive the carry crash. Those who are left—those with sufficient resources—will go on to take an even larger share of wealth and income in the next phase of the regime.

Chapter 13: Beyond the Vanishing Point

Short-term interest rates were only important to the extent that they sent a signal about the central bank’s willingness to support financial markets. If an interest rate increase appears to be part of a process in which the central bank is withdrawing its support for financial markets, and by extension the carry regime, then it is possible that an interest rate increase could trigger a carry crash; the carry crash means the evaporation of liquidity and economic collapse. In this paradigm, whether the economy is strong enough to merit an interest rate increase therefore is a question that misses the point. The right question to ask is whether an interest rate increase could provoke a carry crash. Quantitative easing was even more important in this respect; QE was a giant carry trade in itself.

These features, which are crucial, suggest that the absolute end of the carry regime is likely to be marked by either systemic collapse that ends the dominant role of central banks or galloping inflation—or both. If a crash results in neither of these two things happening, then the likelihood is that the carry regime continues and there will be a new carry bubble.