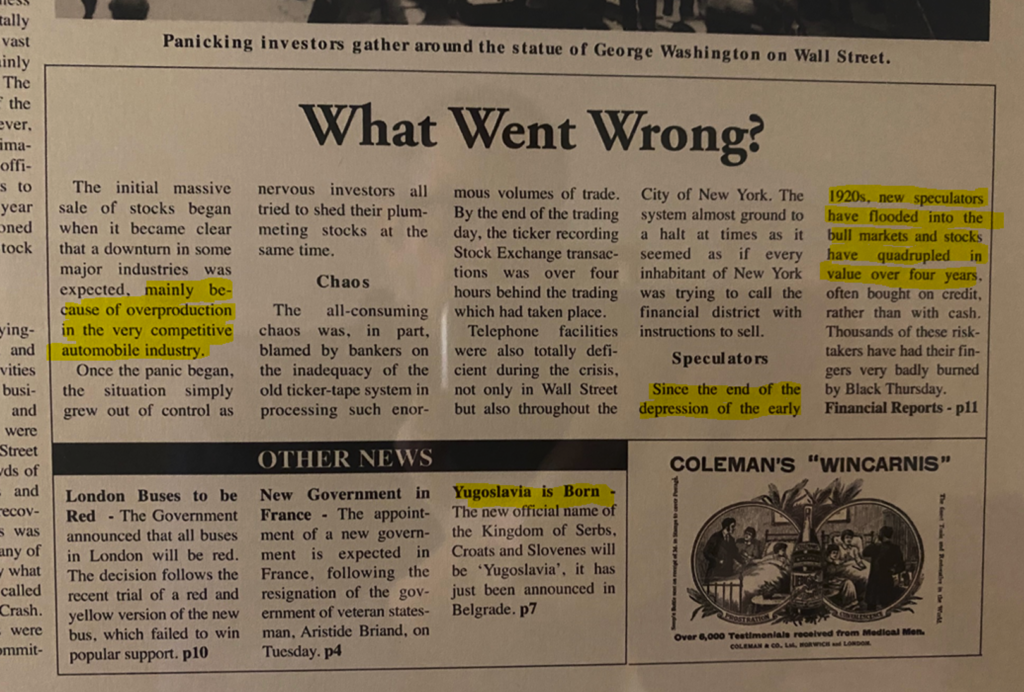

The front page of the London Harold on Friday October 25, 1929 attempts to explain what happened on Black Thursday: “too much speculation,” they conclude. Many other subsequent accounts reached the same conclusion. Andrew Roberts’ biography, Churchill: Walking with Destiny (2018), details how even Winston Churchill got swept into the 1929 stock market bubble: “…against [Bernard] Baruch’s advice, he invested £3,000 in the American stock market. He told his wife this had ‘the best possible chances of success’. Churchill was later to blame the Wall Street Crash on what he called ‘an orgy of speculation’. If that was so, it was an orgy in which he himself had been an enthusiastic participant. The ledger books of his stockbrokers Vickers da Costa reveal that Churchill speculated in a very wide selection of bonds, equities and currencies. In the early 1920s, for example, these included South African and Rhodesian goldmines, the Cunard shipping line, Chinese 4½ per cent bonds, hotel company debentures, the French franc, the British Cellulose Company, British American Tobacco, Eagle Oil, the Burma Corporation, Hungarian 7½ per cent bonds and the Shanghai Electrical Company. He suspended share-dealing during his chancellorship – although Clementine continued to buy small amounts of American equities – but immediately on resigning in June 1929 he bought shares in the Western Union Telegraph, British Oxygen, the Pennroad Corporation, Sherwood Star Goldmining, Canadian Pacific Railways, Western Union Telegraph and the International Nickel Corporation. He was no long-term investor, sometimes buying and selling stock four times in a fortnight; as he told his Canadian commodities trader of an investment in American Rolling Mills in 1929, ‘I do not expect to hold these shares for more than a few weeks.’ His London stockbroker Cecil Vickers urged him to stop dealing in ‘gambling stock’ that year, but he did not, even though companies such as Strike Oil, in which he had a $2,000 stake, signally failed to live up to its name and went into liquidation. … With his preternatural capacity for being at the centre of events when history was being made, Churchill was actually on Wall Street on Black Thursday. The very next day, from directly under his window in the Savoy Plaza Hotel, a man threw himself fifteen storeys down on to the pavement below, causing, as Churchill reported, ‘a wild commotion and the arrival of the fire brigade’. Churchill himself lost around £10,000 (approximately £500,000 in today’s money) virtually overnight.”

Churchill didn’t have good luck with New York. On another trip: “On Sunday, 13 December 1931, having dined at his hotel, the Waldorf Astoria, on Park Avenue and 49th Street, Churchill took a cab 2 miles uptown to Bernard Baruch’s house at 1055 Fifth Avenue, between 86th and 87th Streets. He realized during the journey that he did not know Baruch’s address, but he had stayed there in 1929 and was sure he would recognize the building. He paid off his cab on the Central Park side of Fifth Avenue between 76th and 77th Streets, a full ten blocks south of Baruch’s home. In those days Fifth Avenue had two-way traffic. Churchill began crossing the street, wearing a heavy, fur-lined overcoat, but halfway across, momentarily forgetting he was not in England, he looked left instead of right and was knocked down by a northbound car. The driver was going at about 35mph. He tried to brake, but it was too late. ‘There was one moment – I cannot measure it in time,’ Churchill wrote soon afterwards: of a world aglare, of a man aghast. I certainly thought quickly enough to achieve the idea ‘I am going to be run down and probably killed.’ Then came the blow.” He obviously survived, but not without being hospitalized for two weeks and nursing deep bruises for months.

Incidentally, here’s a picture of the London Herald front page that hangs in my home office above my vintage collection of Churchill’s books, which I inherited from my father in Law.