I have friends and family members who refuse to invest in the stock market because they think it’s a casino. Worse, some think the market is rigged against them. It seems to me that this type of belief is quite widespread and is fed by the constant stream of news of stock prices rising and falling abruptly, without any apparent logic behind it. Indeed, if one looks, without any context, at the movement of stock prices on any given day, or even over a week or month, the numbers can seem to be picked at random. Or worse, they can often seem to contradict the news, giving rise to the conspiracy theories that the market is rigged.

But my retort is that the stock market is actually an upside-down casino. In a normal casino, the odds are always against you. Sure, you can get lucky and guess the winning number in any single roulette game, but if you play long enough you will for sure come out losing. Historically, though, in the stock market the odds favor you. Sure, you can lose money on a specific stock or in a given period, but if you keep at it long enough, you can turn a dollar into one hundred by just waiting.

In the U.S. at least, the stock market has given a higher return than any other form of investment, like bonds, real estate, commodities, or precious metals. And this makes sense. When you invest in stocks, you invest in production and productivity. Companies produce things and provide services. They not only grow, but some get better at it with the passing of time. Real estate, precious metals, commodities and even bonds are things that just sit there. They don’t grow. At most they earn rent. But a house doesn’t double in size by itself. Neither does a bond, which basically just pays rent on your money.

According to a chart published by the NYU’s Stern School of Business (link), $100 invested at the start of 1928 (i.e. before the Great Depression) would be worth $8,867 at year end 2022, if you had put it all in gold. Had you invested it in real estate, it would be worth only $5,121. What about bonds? An investment in U.S. T. Bonds would have transformed the $100 into $7,007, while an investment in grade Baa corporate bonds would have given a much better result: $46,380. But if you had invested your $100 in the S&P 500 index, you would have today a whopping $624,535! That’s more than 13 times the next best alternative!

Sure, there are down years – and sometimes they can be quite extreme. But just like in an upside-down casino where the odds are in your favor, you will win more than you lose (on average). It’s not a straight line, but if you just keep playing, you will come out on top.

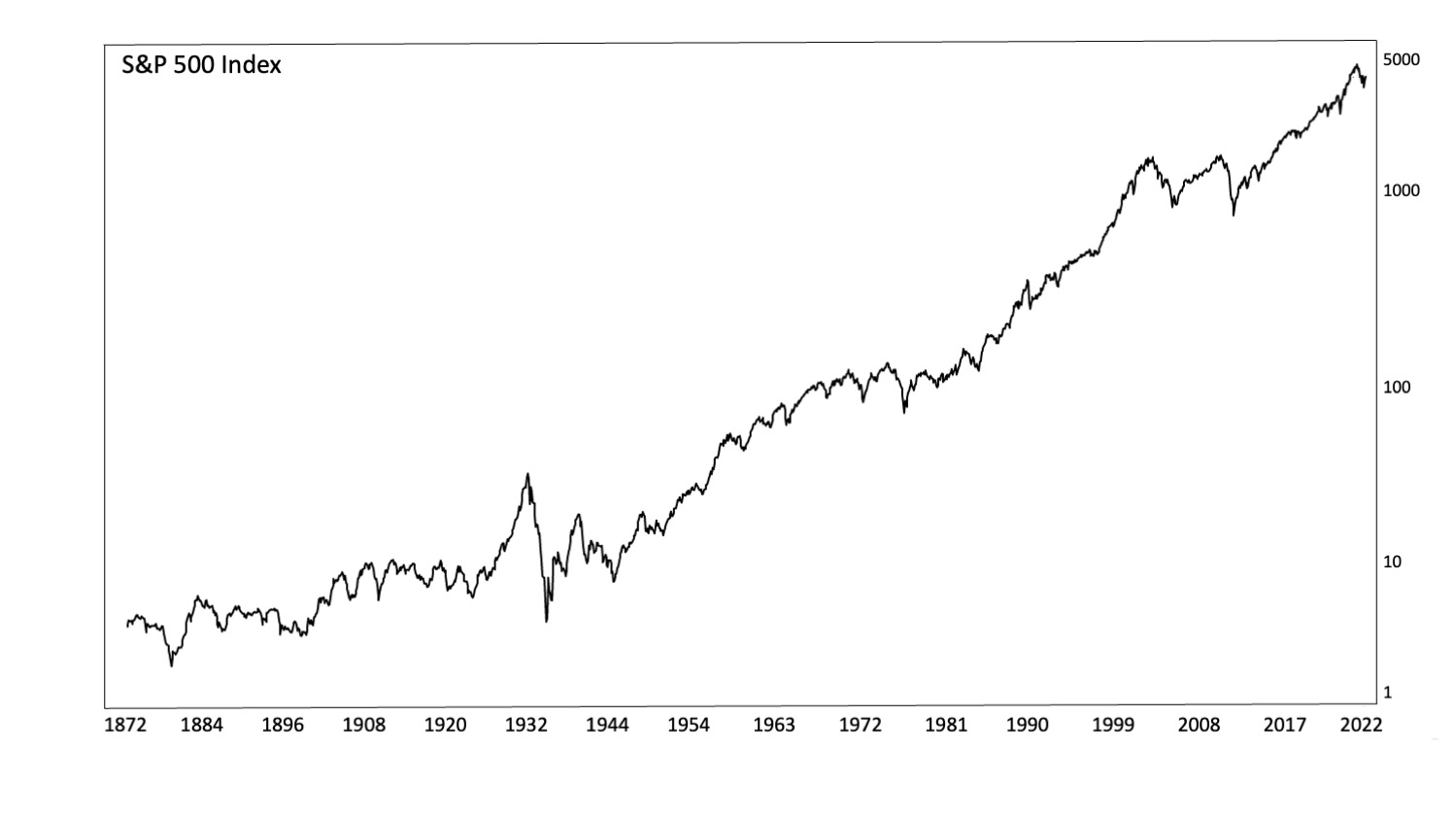

The chart above shows the S&P 500 index over the past 150 years in log scale. Note the general trend line, especially after 1945 (end of WWII and the beginning of the modern economic era of integrated world markets and global trade). The two key takeaways are that a) if you just wait long enough, your investments will multiply, and b) there will be zig zags along the way.

The chart above shows the S&P 500 index over the past 150 years in log scale. Note the general trend line, especially after 1945 (end of WWII and the beginning of the modern economic era of integrated world markets and global trade). The two key takeaways are that a) if you just wait long enough, your investments will multiply, and b) there will be zig zags along the way.

Now, there is one caveat: you have to know what you’re doing. You have to understand that the stock market is not a casino and you can’t start blindly choosing which companies to invest in. You also can’t jump from stock to stock on a whim, like jumping from one roulette table to the next in a casino just because you lost money at the first one. And you need to stay cool and rational when everyone around you is either panicking or irrationally exuberant.

Investing requires knowledge and a certain mindset, and both require much time and study to be acquired. This is where many investors err and end up with the impression that the market is a casino: they act on a hunch, on a rumor or on a whim, instead of deeply researching the companies they invest in to gain the conviction needed to stick with them through the natural ups and downs of the market.

If you don’t have the time, will or patience to do this homework, but still wish to capture the outsized gains that the stock market can bring you over the long run, consider investing with a market professional. But if you do have the time and the inclination, I suggest that you focus on the companies and not the markets. It’s the companies that have the people that wake up every day to work for you. Your investment should not be seen as a position in the stock market, but as a piece of ownership in businesses that grow and prosper. If you do it right and stick with it, then it becomes highly likely your dreams will come true.